Understanding the Basics: What is Offset in Accounting

Offset in accounting refers to the process of balancing debit and credit entries to maintain the overall accuracy and integrity of financial records. This technique is a fundamental aspect of double-entry bookkeeping, ensuring that every financial transaction is accurately represented in the company’s books. The concept of offset is essential for accountants and financial professionals to understand, as it impacts the accounting process and financial statements.

The Role of Offset in Double-Entry Bookkeeping

Offset in double-entry bookkeeping is a critical technique that ensures the balance between debit and credit entries. In this system, each financial transaction is recorded as both a debit and a credit in separate accounts, maintaining the equality of the total debits and credits. Offset transactions simplify the accounting process by reducing the need for separate entries for every financial transaction, ultimately streamlining record-keeping and financial reporting.

For instance, when a cash sale is made, the cash account is debited, and the sales account is credited. If the company receives payment for an account receivable, the accounts receivable account is debited (offset), and the cash account is credited. This offsetting process ensures that the financial records accurately reflect the company’s financial position.

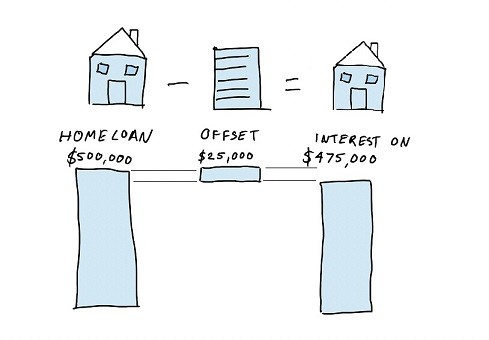

Offset in Accounts Receivable and Payable

Offset in accounts receivable and payable is a common practice that simplifies the accounting process. When a company provides goods or services to a customer on credit, an account receivable is created. Conversely, when a company purchases goods or services on credit, an account payable is established.

Offset transactions occur when a customer pays an outstanding account receivable with a payment that is due to the company. For example, a customer owes a company $1,000 for a previous purchase, and the company, in turn, owes the same customer $800 for a recent return or credit. Instead of issuing two separate transactions, the company can offset the amounts, debiting the accounts receivable for $1,000 and crediting the accounts payable for $800, resulting in a net payment of $200.

Offset transactions in accounts receivable and payable must be accurately recorded and reported to maintain proper financial records. When offsetting, it is essential to ensure that the accounts are appropriately adjusted, and the correct amounts are applied to each account. Proper documentation and clear communication between the company and its customers are crucial to avoid errors and maintain financial accuracy.

How to Properly Implement Offset in Accounting

Implementing offset in accounting requires careful attention to detail and adherence to best practices. To correctly implement offset, follow these steps:

-

Verify the accuracy of the offsetting entries. Ensure that the amounts, accounts, and documentation are correct before proceeding with the offset.

-

Record the offset in a timely manner. Delays in recording offset transactions can result in discrepancies in financial records and reporting errors.

-

Maintain proper documentation. Keep detailed records of all offset transactions, including the original transactions, offset amounts, and dates. This documentation will help ensure accuracy and facilitate audits and internal controls.

-

Communicate with relevant parties. Clearly communicate with customers, vendors, or other relevant parties regarding offset transactions to avoid misunderstandings and maintain positive relationships.

-

Regularly review and reconcile accounts. Periodically review and reconcile accounts to ensure that offset transactions have been accurately recorded and reported. This practice will help maintain financial accuracy and transparency.

When implementing offset in accounting, it is crucial to avoid common pitfalls, such as:

-

Inaccurate offset entries

-

Delayed recording of offset transactions

-

Poor documentation

-

Inadequate communication with relevant parties

-

Infrequent account reviews and reconciliations

By following best practices and avoiding common pitfalls, you can ensure accurate and consistent offsetting entries in your accounting process.

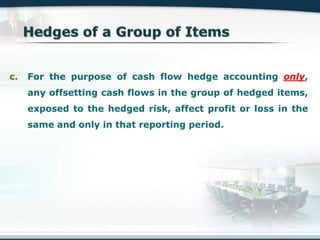

Offset in Financial Instruments and Hedging Strategies

Offset in financial instruments and hedging strategies is a powerful tool for managing risk and optimizing financial performance. By offsetting positions in various financial markets, companies can mitigate potential losses and enhance overall profitability.

For example, consider a company that has a long position in a stock but is concerned about a potential market downturn. The company can offset this risk by taking a short position in a related stock index futures contract. If the stock market declines, the gain on the short position will help offset the loss on the long position, effectively reducing the company’s overall risk exposure.

Offset strategies can also be employed in foreign exchange markets. A company with significant foreign currency exposures can hedge against currency fluctuations by taking offsetting positions in currency forwards, options, or swaps. This approach can help protect the company’s earnings and cash flows from adverse currency movements.

Offsetting positions in financial instruments and hedging strategies requires careful planning, analysis, and execution. Companies should consider factors such as market conditions, risk tolerance, and financial objectives when implementing offset strategies. It is also essential to regularly monitor and adjust these positions as market conditions change to ensure continued effectiveness and risk management.

Incorporating offset strategies into financial instruments and hedging can help companies achieve a variety of objectives, including:

-

Reducing risk exposure

-

Enhancing financial performance

-

Preserving capital

-

Improving earnings stability

By understanding and utilizing offset in financial instruments and hedging strategies, companies can better manage risk and optimize financial performance in today’s complex and dynamic financial markets.

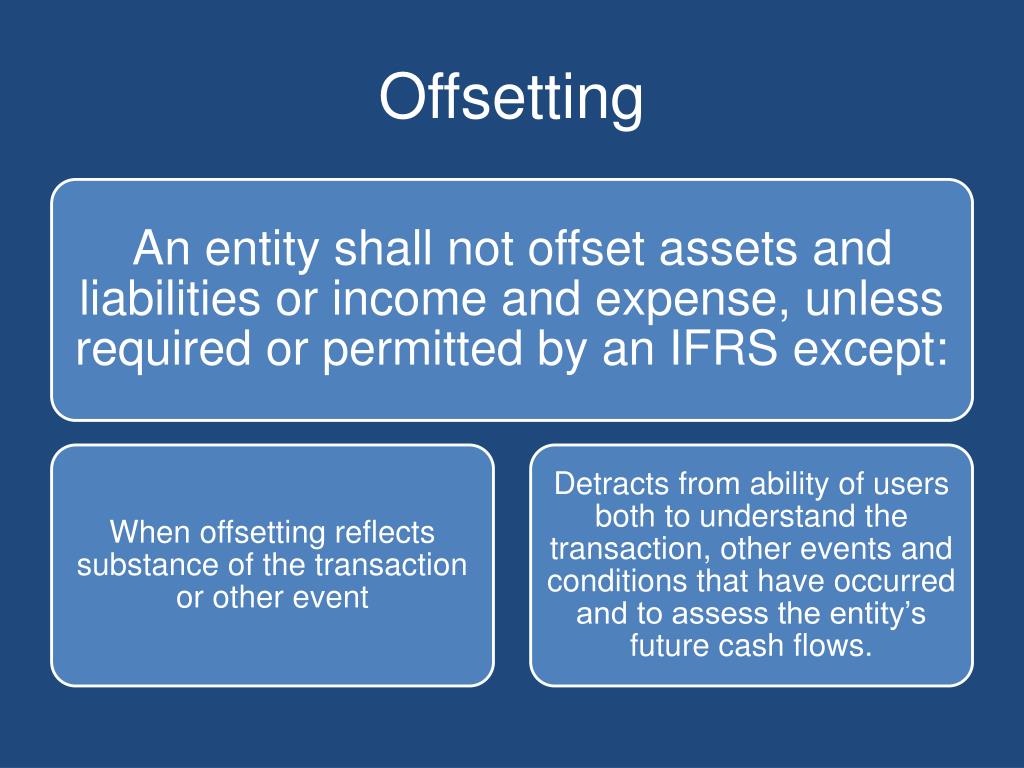

The Impact of Offset on Financial Statements

Offset in accounting has a significant influence on financial statements, affecting key financial metrics and ratios. Understanding the impact of offset is crucial for interpreting financial reports accurately and making informed financial decisions.

Offset transactions can affect various financial statement line items, such as revenues, expenses, assets, and liabilities. For instance, when a company offsets an account receivable against an account payable, the net effect on the balance sheet is a reduction in both assets and liabilities. Similarly, when a company offsets a gain on a financial instrument against a loss on a related instrument, the net effect on the income statement is a reduction in total gains or losses.

Offset transactions can also impact financial ratios, such as the current ratio, quick ratio, and debt-to-equity ratio. For example, if a company offsets a current asset against a current liability, the current ratio may remain unchanged, even if the individual components of the ratio have changed. This situation can make it difficult to assess the company’s liquidity accurately.

To ensure accurate financial reporting, it is essential to properly record and report offset transactions in financial statements. Companies should follow generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) when accounting for offset transactions. These standards provide guidelines on how to report offset transactions and ensure consistency and transparency in financial reporting.

When interpreting financial statements, investors, analysts, and financial professionals should be aware of the potential impact of offset transactions. By understanding the influence of offset on financial metrics and ratios, they can make more informed assessments of a company’s financial health and performance.

Offset in Internal Controls and Auditing

Offset in internal controls and auditing plays a significant role in ensuring financial accuracy and transparency. Properly implemented offsetting entries can help maintain the integrity of financial records, while inaccurate or inconsistent offsets can result in material misstatements and potential fraud.

Internal controls are processes designed to provide reasonable assurance regarding the achievement of an organization’s objectives in areas such as effectiveness and efficiency of operations, reliability of financial reporting, and compliance with applicable laws and regulations. Offset transactions must be appropriately managed within these internal controls to ensure accuracy and consistency.

Auditors play a critical role in assessing offset transactions during the audit process. They evaluate the design and effectiveness of internal controls related to offset, ensuring that offsetting entries are properly authorized, recorded, and reported. Auditors also test the accuracy and completeness of offset transactions, identifying any discrepancies or irregularities that may require adjustment.

To maintain strong internal controls and facilitate audits, companies should:

-

Establish clear policies and procedures for offset transactions

-

Ensure proper authorization and approval processes

-

Maintain detailed documentation and records

-

Regularly review and reconcile offset transactions

-

Provide training and communication to employees

By effectively managing offset in internal controls and auditing, companies can enhance financial accuracy, transparency, and compliance, ultimately building trust and credibility with stakeholders.

Navigating Offset Regulations and Compliance

Navigating the regulatory landscape surrounding offset in accounting is crucial for staying compliant and avoiding potential penalties or fines. Various laws and standards govern the use of offset, and companies must adhere to these guidelines to ensure accurate financial reporting and maintain credibility with stakeholders.

In the United States, the Financial Accounting Standards Board (FASB) sets accounting standards through the Generally Accepted Accounting Principles (GAAP). The FASB provides guidance on offsetting through its Accounting Standards Codification (ASC) Topic 210, Balance Sheet (Topic 840, Leases, for leases offsetting guidance). Companies must follow these standards when presenting offsetting positions in their financial statements.

Internationally, the International Accounting Standards Board (IASB) sets accounting standards through the International Financial Reporting Standards (IFRS). IFRS 7, Financial Instruments: Disclosures, provides guidance on offsetting arrangements, and IAS 32, Financial Instruments: Presentation, outlines the criteria for offsetting financial assets and liabilities.

To stay compliant with offset regulations and standards, companies should:

-

Stay informed about updates to GAAP, IFRS, and other relevant accounting standards

-

Consult with accounting professionals and subject matter experts

-

Implement proper internal controls and auditing practices

-

Regularly review and update offset policies and procedures

By adhering to offset regulations and standards, companies can maintain accurate financial records, ensure transparency, and build trust with investors, analysts, and other stakeholders.