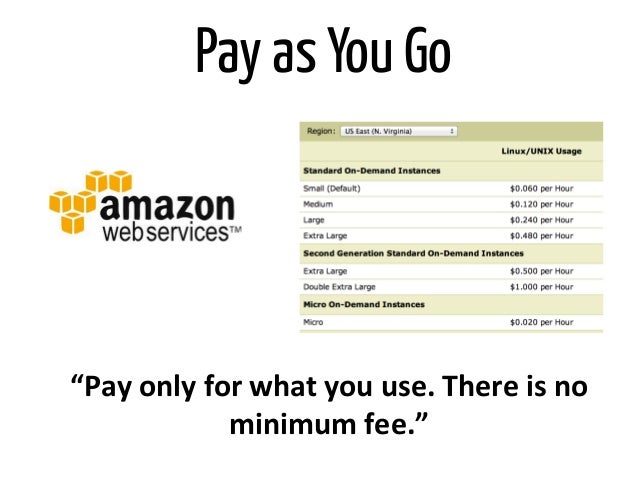

What is the Pay As You Go Model?

The pay as you go model, also known as pay-as-you-go or paygo, is a flexible and cost-effective payment method that allows customers to pay for goods or services based on their actual usage, rather than committing to a fixed contract or subscription. This payment structure offers numerous advantages, including increased flexibility, reduced financial risk, and lower overall costs for both businesses and consumers.

In contrast to traditional payment methods, the pay as you go model eliminates the need for long-term commitments, upfront payments, or estimates of future usage. Instead, customers only pay for what they use, making it an attractive option for those seeking to manage their budgets more effectively or avoid being locked into lengthy contracts. This model is particularly prevalent in industries where usage can vary significantly, such as telecommunications, energy, and transportation.

Key Industries Utilizing the Pay As You Go Model

The pay as you go model has gained significant traction across various industries, offering customers a more flexible and cost-effective alternative to traditional payment methods. Some of the key industries where this model is prevalent include:

- Telecommunications: Mobile network operators and internet service providers often offer pay as you go plans, allowing customers to pay for their data, voice, and messaging usage without being tied to long-term contracts.

- Energy: Energy suppliers may provide pay as you go options for electricity and gas, enabling customers to monitor and manage their usage more effectively and avoid large upfront costs.

- Transportation: Car-sharing and ride-hailing services, such as Zipcar and Uber, utilize the pay as you go model, enabling users to pay for transportation only when needed.

- Insurance: Insurance companies offer pay as you go policies for car insurance, where premiums are based on actual mileage driven, promoting safer driving habits and reducing costs for low-mileage drivers.

- Software and Software as a Service (SaaS): Software providers offer pay as you go models for their products, allowing customers to pay for the software based on their usage, rather than purchasing a license upfront.

Prominent companies and services that utilize the pay as you go model include O2, EE, Vodafone, and Three in the telecommunications sector; British Gas, E.ON, and OVO Energy in the energy industry; Zipcar, Uber, and Lyft in transportation; and Metromile, By Miles, and Nationwide’s Flexidrive in the insurance sector. These companies have experienced success with the pay as you go model, attracting customers seeking more affordable and adaptable payment options.

How to Implement a Pay As You Go System

Implementing a pay as you go model for a business involves several key steps to ensure a smooth transition and successful adoption. By following these guidelines, businesses can effectively leverage the benefits of this payment method and enhance customer satisfaction:

- Identify target customers: Determine the customer segments that are most likely to benefit from and adopt the pay as you go model. These may include customers seeking flexibility, lower costs, or reduced commitment.

- Set up billing and payment systems: Develop a robust and secure billing infrastructure that supports real-time usage tracking and accurate, timely invoicing. Implement user-friendly payment methods, such as credit/debit cards, direct debit, or digital wallets, to facilitate seamless transactions.

- Monitor usage patterns: Continuously track and analyze customer usage patterns to identify trends, optimize pricing, and forecast future demand. Utilize data analytics tools and techniques to extract valuable insights and make data-driven decisions.

- Communicate transparently: Clearly communicate the terms and conditions of the pay as you go model to customers, including any potential hidden fees, usage limits, or penalties. Ensure that customers understand their responsibilities and the benefits of this payment method.

- Provide exceptional customer support: Offer responsive and knowledgeable customer support to address any questions, concerns, or issues related to the pay as you go model. Ensure that customer support representatives are well-versed in the intricacies of this payment method and can provide accurate and helpful assistance.

- Iterate and improve: Continuously evaluate the performance of the pay as you go model and make adjustments as needed. Solicit customer feedback and incorporate it into the design and implementation of the payment system to ensure a positive user experience and long-term success.

Advantages and Disadvantages of the Pay As You Go Model

The pay as you go model offers numerous benefits for both businesses and consumers, but it is essential to consider potential drawbacks to ensure a successful implementation and user experience. By understanding the advantages and disadvantages of this payment method, businesses and consumers can make informed decisions and mitigate potential issues.

Advantages for businesses:

- Increased customer base: The pay as you go model can attract a broader range of customers who may have been deterred by long-term contracts or high upfront costs.

- Improved cash flow: By receiving regular payments based on actual usage, businesses can better manage their cash flow and financial forecasting.

- Reduced risk: The pay as you go model can help businesses reduce the risk associated with estimating future usage or demand, leading to more accurate financial planning.

- Enhanced customer satisfaction: Offering a flexible and cost-effective payment method can improve customer satisfaction and loyalty, ultimately driving long-term business growth.

Advantages for consumers:

- Flexibility: The pay as you go model enables consumers to pay for goods or services only when needed, without being tied to long-term contracts or minimum usage requirements.

- Cost-effectiveness: Paying for usage as it occurs can help consumers manage their budgets more effectively, avoiding the need for large upfront payments or long-term financial commitments.

- Reduced risk: Consumers can avoid the risk of overpaying for services they do not use or being locked into unfavorable contracts.

- Customization: The pay as you go model allows consumers to tailor their usage to their specific needs, providing a more personalized and user-friendly experience.

Disadvantages for businesses:

- Potential hidden fees: Businesses must ensure that their pay as you go model does not include hidden fees or penalties that could negatively impact customer trust and satisfaction.

- Customer retention: Retaining customers in a pay as you go model can be more challenging, as they are not bound by long-term contracts and may switch providers more frequently.

- Usage tracking: Accurately tracking and billing customer usage can be complex and resource-intensive, requiring robust billing systems and processes.

Disadvantages for consumers:

- Usage monitoring: Consumers must actively monitor their usage to avoid unexpected charges or exceeding their budgets.

- Potential for higher costs: In some cases, the pay as you go model may result in higher overall costs for consumers, particularly if they have consistent or heavy usage patterns.

The Future of the Pay As You Go Model

The pay as you go model has experienced significant growth and adoption across various industries, and its future outlook remains promising. As technology advances and regulatory considerations evolve, the pay as you go model is expected to continue expanding and reshaping the way businesses and consumers interact with products and services.

Potential growth areas:

- Internet of Things (IoT): The proliferation of IoT devices and smart home technology presents an opportunity for the pay as you go model to expand into new markets, such as home automation, security, and energy management.

- Financial services: Financial institutions and fintech companies are increasingly exploring the pay as you go model for services like loans, insurance, and investments, offering customers more personalized and flexible options.

- Healthcare: The healthcare industry is beginning to adopt the pay as you go model for services like telemedicine, medical equipment rental, and health insurance, providing patients with greater control over their healthcare spending.

Technological advancements:

- Artificial intelligence (AI) and machine learning: AI and machine learning technologies can help businesses optimize their pay as you go systems by predicting usage patterns, automating billing processes, and identifying potential issues before they impact customers.

- Blockchain and smart contracts: Blockchain technology and smart contracts can provide secure, transparent, and tamper-proof record-keeping for pay as you go systems, enhancing trust and accountability between businesses and consumers.

- 5G networks: The rollout of 5G networks will enable faster and more reliable data transfer, paving the way for innovative pay as you go applications in industries like telecommunications, transportation, and entertainment.

Regulatory considerations:

- Data privacy: As pay as you go systems rely on customer usage data, businesses must ensure compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), to protect customer information and maintain trust.

- Consumer protection: Governments and regulatory bodies may introduce new consumer protection measures to safeguard customers from potential abuses or unfair practices in pay as you go systems, ensuring a fair and transparent user experience.

How to Choose the Right Pay As You Go Service

Selecting the ideal pay as you go service can significantly impact your overall experience and satisfaction. By carefully evaluating various factors, you can make an informed decision and choose a service that aligns with your needs and preferences. Here are some essential tips to help you choose the best pay as you go service:

Evaluate pricing:

- Compare the pricing structures of different service providers to ensure you are getting the best value for your money.

- Look for transparent pricing with no hidden fees or unexpected charges.

- Consider any introductory offers, discounts, or promotions that may be available to new customers.

Assess features:

- Identify the features that are most important to you and ensure the service provider offers them.

- Consider factors such as coverage area, data speeds, customer support, and additional perks or benefits.

- Determine whether the service provider offers a mobile app or online platform for easy account management and usage tracking.

Review customer support:

- Check if the service provider offers multiple channels for customer support, such as phone, email, or live chat.

- Research customer reviews and ratings to gauge the quality and responsiveness of the support team.

- Look for resources such as FAQs, tutorials, or user guides to help you troubleshoot common issues.

Understand the terms and conditions:

- Read the fine print before committing to a pay as you go service to ensure you are aware of any usage limits, contract terms, or cancellation policies.

- Verify if there are any penalties for exceeding usage limits or early contract termination.

- Ensure the service provider has a clear and straightforward process for updating or changing your plan or service features.

By following these tips and carefully considering your options, you can choose a pay as you go service that meets your needs, offers excellent value, and delivers a positive user experience.

Real-World Applications of the Pay As You Go Model

The pay as you go model has been successfully implemented across various industries, transforming the way businesses operate and customers consume goods and services. By examining real-world applications and case studies, we can better understand the positive impact of this payment method and its potential for long-term growth and success.

Telecommunications: O2’s Pay As You Go Simplicity

- UK-based telecommunications giant O2 has leveraged the pay as you go model to attract a diverse customer base seeking flexibility and cost-effectiveness.

- O2’s Pay As You Go Simplicity plan offers customers a straightforward pricing structure, with no contracts, credit checks, or hidden fees.

- Customers can top up their accounts with varying amounts, providing them with complete control over their spending and usage.

Energy: OVO Energy’s Pay As You Go Plan

- UK energy supplier OVO Energy has introduced a pay as you go plan that enables customers to monitor and manage their energy usage in real-time.

- The plan includes a smart meter, which allows customers to top up their accounts online, via a mobile app, or at local retailers.

- OVO Energy’s pay as you go plan has been praised for its transparency, affordability, and user-friendly interface, resulting in increased customer satisfaction and retention.

Transportation: Zipcar’s Flexible Car-Sharing Service

- Car-sharing service Zipcar has effectively implemented the pay as you go model, offering customers an affordable and flexible alternative to traditional car rental and ownership.

- Zipcar members can reserve a vehicle for as little as an hour or for an entire day, with fuel, insurance, and maintenance costs included in the hourly or daily rate.

- By eliminating the need for long-term contracts and upfront fees, Zipcar has attracted a wide range of customers seeking convenient and cost-effective transportation solutions.

These real-world applications demonstrate the versatility and potential of the pay as you go model. By offering customers flexibility, cost-effectiveness, and reduced commitment, businesses can enhance their operations, increase customer satisfaction, and maintain a competitive edge in their respective industries.

Potential Challenges and Solutions in Adopting the Pay As You Go Model

Implementing the pay as you go model can present businesses with unique challenges, requiring careful planning, execution, and ongoing management. By understanding these challenges and implementing appropriate solutions, businesses can successfully adopt this payment method and reap its numerous benefits.

Customer resistance:

- Customers may be hesitant to adopt the pay as you go model due to a lack of understanding or concerns about potential hidden fees and costs.

- Solution: Clearly communicate the benefits of the pay as you go model, emphasizing flexibility, cost-effectiveness, and reduced commitment. Provide detailed information about pricing structures, usage tracking, and customer support to alleviate customer concerns and build trust.

Integration with existing systems:

- Integrating the pay as you go model with existing billing, payment, and customer management systems can be complex and time-consuming.

- Solution: Collaborate with experienced technology partners and service providers to ensure a seamless integration process. Test and validate the new systems thoroughly before launching to minimize disruptions and potential errors.

Data security:

- The pay as you go model relies on real-time usage tracking and data collection, which can raise concerns about data privacy and security.

- Solution: Implement robust data protection measures, such as encryption, secure data storage, and regular security audits, to ensure customer data is protected and compliant with relevant regulations.

Customer retention:

- Customer retention can be more challenging in the pay as you go model due to reduced long-term commitments and increased competition.

- Solution: Focus on delivering exceptional customer experiences, including responsive customer support, personalized service, and ongoing engagement through targeted marketing campaigns and loyalty programs.

By addressing these challenges and implementing effective solutions, businesses can successfully adopt the pay as you go model and capitalize on its potential to drive growth, enhance customer satisfaction, and maintain a competitive edge in their respective industries.