Capital Expenditures (Capex) and Operational Expenditures (Opex): An Overview

Capital Expenditures (Capex) and Operational Expenditures (Opex) are two fundamental categories of expenses that companies incur in their pursuit of business objectives. Understanding the nuances of Capex and Opex is crucial for effective financial management and strategic decision-making. The “difference between capex and opex” lies at the heart of various financial considerations, impacting a company’s balance sheet, income statement, cash flow, and tax obligations.

Capital Expenditures (Capex): In-depth Analysis

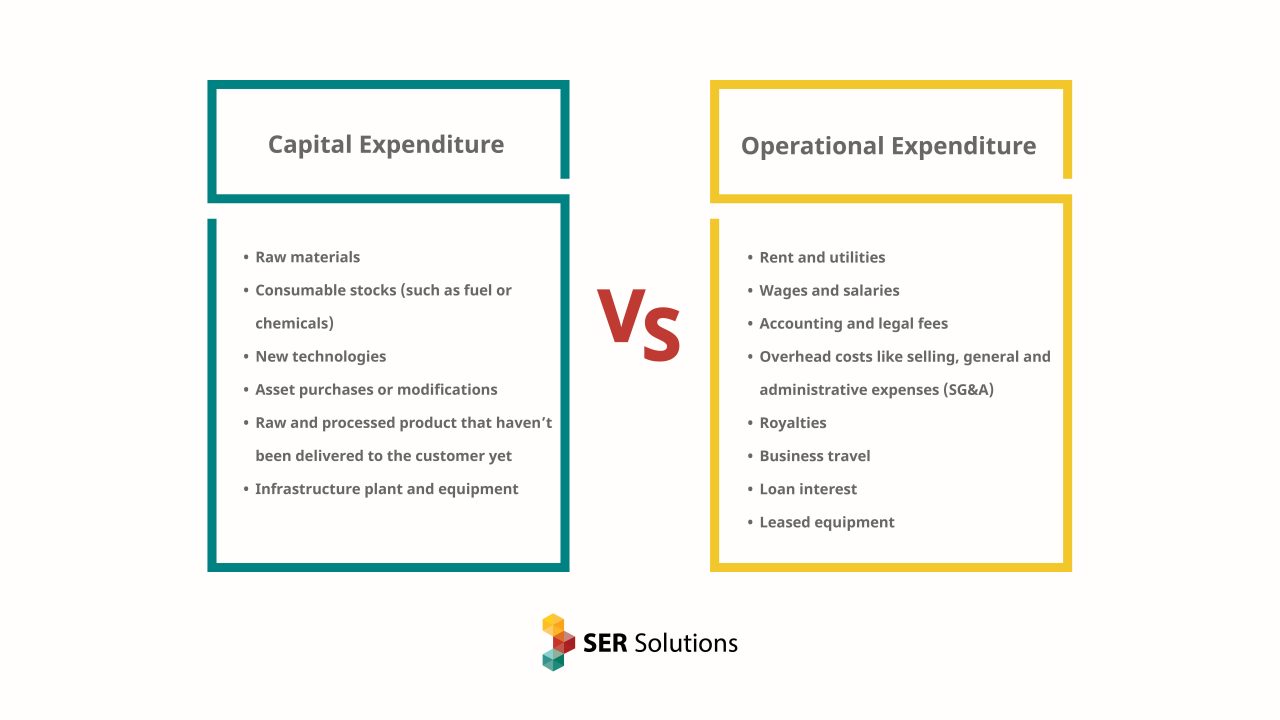

Capital Expenditures (Capex) represent investments in long-term assets that a company deploys to facilitate business operations, generate revenue, and enhance financial health. Common examples of Capex include purchasing new machinery, constructing buildings, or upgrading existing infrastructure. The “difference between capex and opex” becomes evident when comparing their accounting treatments and financial impacts.

Unlike Operational Expenditures (Opex), which are immediately expensed and reflected on the income statement, Capex is capitalized and reported on the balance sheet as Property, Plant, and Equipment (PP&E). The gradual depreciation or amortization of Capex is then recorded as an expense on the income statement over the asset’s useful life. This accounting treatment allows companies to spread the cost of long-term investments over time, providing a more accurate representation of their financial performance.

Capex significantly influences a company’s long-term growth prospects and financial health. By investing in new or upgraded assets, businesses can improve their production capabilities, reduce operational costs, and increase revenue potential. Consequently, Capex can enhance a company’s competitive position, facilitate market expansion, and support its strategic objectives. However, it is essential to strike an optimal balance between Capex and Opex, as excessive Capex can strain cash flow and negatively impact short-term profitability.

Operational Expenditures (Opex): A Comprehensive Look

Operational Expenditures (Opex) encompass the day-to-day expenses that a company incurs in its regular business operations. These costs are necessary for maintaining ongoing business activities and are typically expensed in the period they are incurred. Common examples of Opex include salaries, utilities, rent, and office supplies. Understanding the “difference between capex and opex” is crucial for effective financial management and strategic decision-making, as these two categories of expenses have distinct accounting treatments and financial implications.

Unlike Capex, Opex is directly reflected on the income statement as an expense in the period it is incurred. This accounting treatment allows companies to accurately represent their short-term financial performance, as Opex provides a clear picture of the ongoing costs required to maintain business operations. However, Opex does not contribute to long-term assets or provide long-term benefits, as it primarily focuses on immediate expenses necessary for day-to-day operations.

Opex plays a critical role in a company’s short-term financial performance, as it directly impacts the bottom line. By effectively managing Opex, businesses can optimize their day-to-day expenses, improve cash flow, and enhance profitability. However, excessive Opex can strain financial resources and hinder a company’s ability to invest in long-term growth initiatives, such as Capex.

Key Differences Between Capex and Opex

The “difference between capex and opex” extends beyond their definitions and accounting treatments, as these two categories of expenses have distinct implications for a company’s financial health, growth prospects, and operational efficiency. By understanding the key differences between Capex and Opex, businesses can optimize their financial management and decision-making processes.

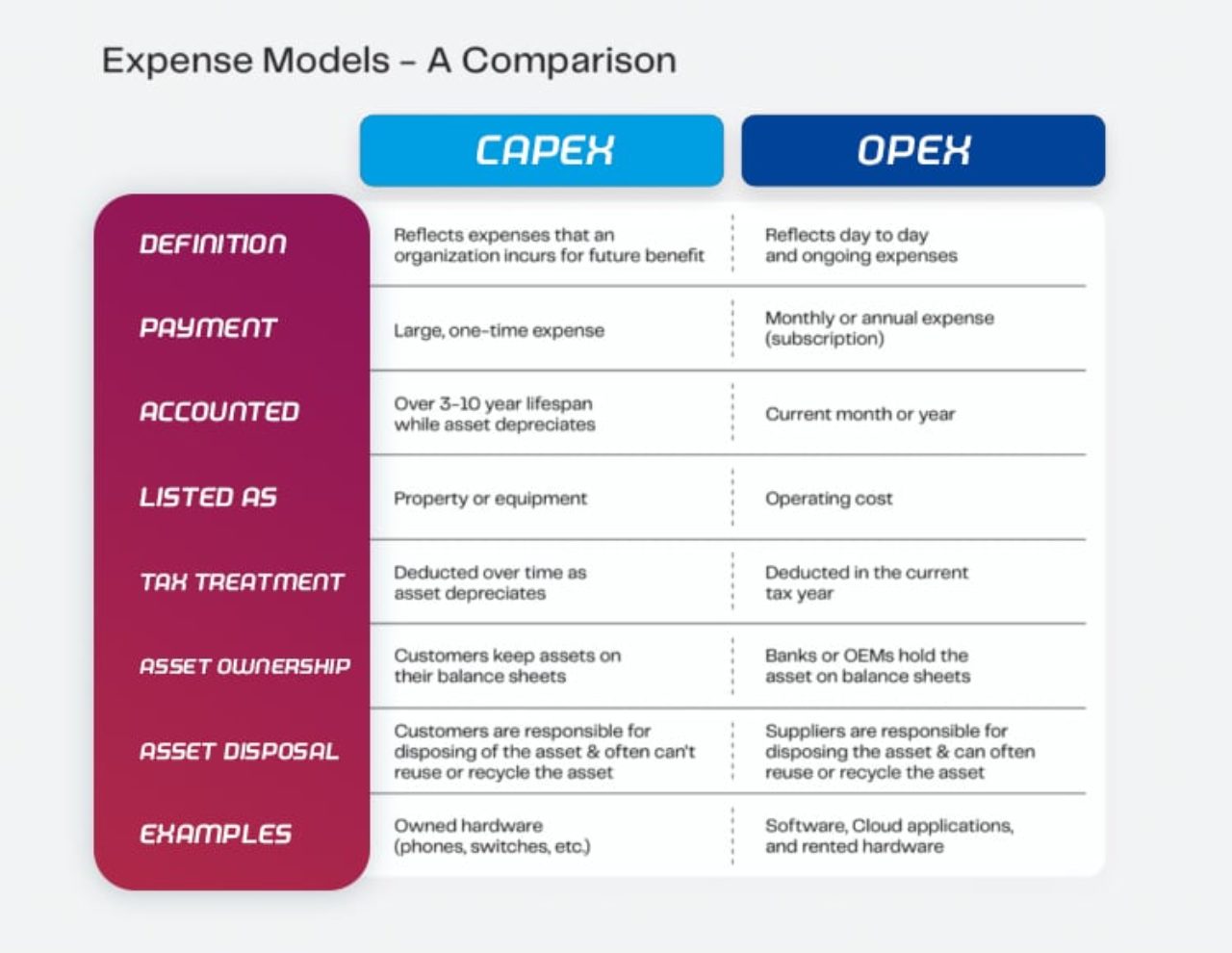

- Treatment in Financial Statements: Capex is capitalized and reported on the balance sheet as PP&E, while Opex is expensed on the income statement in the period it is incurred. This difference in accounting treatment allows companies to accurately represent their short-term financial performance (Opex) and long-term financial health and growth prospects (Capex).

- Tax Implications: Capex is tax-deductible over the asset’s useful life through depreciation or amortization, while Opex is deducted as an expense in the period it is incurred. This difference can impact a company’s tax liability and cash flow.

- Impact on Cash Flow and Profitability: Capex investments can temporarily reduce cash flow and profitability, while Opex expenses directly impact short-term profitability. Companies must balance these expenditures to achieve long-term growth and short-term profitability.

Recognizing the differences between Capex and Opex is essential for effective financial management, strategic decision-making, and operational efficiency. By understanding the unique characteristics and implications of these two categories of expenses, businesses can optimize their spending, allocate resources wisely, and enhance their overall financial performance.

How to Determine Whether an Expense is Capex or Opex

Properly classifying expenses as either Capex or Opex is essential for accurate financial reporting and informed decision-making. By following a step-by-step approach, businesses can ensure that they are categorizing expenses appropriately and effectively managing their financial resources. Here’s a guide on how to determine whether an expense is Capex or Opex:

- Identify the nature of the expense: Begin by understanding the purpose and intended use of the expense. Capex typically involves investments in long-term assets that will generate value over multiple periods, while Opex relates to day-to-day expenses required to maintain business operations.

- Determine the asset’s useful life: Assess the expected lifespan of the asset associated with the expense. Capex assets generally have a useful life of more than one year, while Opex expenses are typically associated with assets or services with a useful life of one year or less.

- Consider the accounting treatment: Understand the accounting treatment for each type of expense. Capex is capitalized and reported on the balance sheet, while Opex is expensed on the income statement in the period it is incurred.

- Evaluate the impact on cash flow and profitability: Analyze the short-term and long-term effects of the expense on cash flow and profitability. Capex investments can temporarily reduce cash flow and profitability, while Opex expenses directly impact short-term profitability.

- Review financial statement classifications: Check the company’s financial statements to determine how similar expenses have been classified in the past. Consistency in financial reporting is essential for accurate comparisons and decision-making.

Properly classifying Capex and Opex expenses is crucial for effective financial management, strategic decision-making, and regulatory compliance. By following this step-by-step guide, businesses can ensure that they are categorizing expenses appropriately and making informed decisions about their financial resources.

The Interplay Between Capex and Opex: A Strategic Perspective

Balancing Capex and Opex is a critical aspect of strategic financial management, as these two categories of expenses have distinct implications for a company’s financial health, growth prospects, and operational efficiency. By optimizing their spending on Capex and Opex, businesses can achieve long-term growth and short-term profitability while maintaining a healthy financial position.

To effectively manage the interplay between Capex and Opex, companies should:

- Establish a clear financial strategy: Develop a comprehensive financial strategy that aligns with the organization’s overall objectives and considers both Capex and Opex investments. This strategy should outline the company’s risk tolerance, growth targets, and cash flow requirements.

- Prioritize investments: Evaluate potential Capex and Opex investments based on their expected return on investment (ROI), alignment with strategic objectives, and impact on financial performance. Prioritize high-ROI projects that support long-term growth and short-term profitability.

- Monitor and adjust: Regularly review Capex and Opex spending to ensure alignment with the financial strategy and to identify opportunities for optimization. Make adjustments as needed to maintain a balance between Capex and Opex that supports the company’s strategic objectives and financial health.

- Maintain financial flexibility: Ensure adequate cash reserves and financing options to accommodate unexpected Capex or Opex needs, market fluctuations, or changes in strategic direction. Financial flexibility is essential for managing the interplay between Capex and Opex and maintaining a healthy financial position.

By understanding the strategic implications of balancing Capex and Opex, businesses can optimize their spending, allocate resources wisely, and enhance their overall financial performance. A well-thought-out approach to managing these expenditures can help companies achieve their financial and operational objectives, both in the short and long term.

Capex and Opex in Practice: Real-World Examples

Understanding the “difference between capex and opex” is essential, but applying this knowledge in real-world scenarios can be even more enlightening. By examining how companies in various industries manage these expenditures, businesses can learn valuable lessons and best practices for optimizing their financial performance.

Example 1: Technology Company

A technology company must decide whether to purchase servers (Capex) or lease cloud computing services (Opex) to support its operations. By leasing cloud services, the company can maintain flexibility, reduce upfront costs, and convert a significant Capex investment into a more manageable Opex expense. However, the company should weigh the long-term costs and potential benefits of server ownership against the convenience and scalability of cloud services.

Example 2: Manufacturing Firm

A manufacturing firm is considering upgrading its production equipment. By investing in new machinery (Capex), the company can improve efficiency, reduce long-term maintenance costs, and enhance its competitive position. However, this investment may strain short-term cash flow and require a thorough cost-benefit analysis to ensure the long-term benefits outweigh the upfront costs.

Example 3: Retail Chain

A retail chain must decide whether to purchase or lease its store locations. By purchasing real estate (Capex), the company can build equity and gain more control over its facilities. However, leasing (Opex) may provide more flexibility, reduce upfront costs, and allow the company to allocate capital toward other growth initiatives.

By examining these real-world examples, businesses can better understand the trade-offs between Capex and Opex and make informed decisions about managing these expenditures to achieve their financial and operational objectives.

Navigating the Complexities of Capex and Opex: Best Practices and Pitfalls to Avoid

Effectively managing Capex and Opex requires a strategic approach, careful planning, and a thorough understanding of the unique needs and circumstances of each organization. By following best practices and avoiding common pitfalls, businesses can optimize their financial performance, achieve long-term growth, and maintain short-term profitability.

Best Practices

- Perform thorough cost-benefit analyses: Before making any significant Capex or Opex decisions, conduct a comprehensive cost-benefit analysis to ensure that the benefits outweigh the costs and align with the organization’s strategic objectives.

- Establish clear financial policies: Develop and implement clear financial policies that outline the company’s approach to Capex and Opex, including approval processes, budgeting, and reporting procedures.

- Regularly review and adjust: Regularly review Capex and Opex expenditures to ensure alignment with strategic objectives and to identify opportunities for optimization. Make adjustments as needed to maintain a balance between Capex and Opex that supports the company’s financial health.

- Monitor industry trends: Stay informed about industry trends and best practices related to Capex and Opex management. Adapt your strategies as needed to remain competitive and capitalize on new opportunities.

Pitfalls to Avoid

- Underestimating long-term costs: Be cautious not to underestimate the long-term costs associated with Capex investments, as these can have a significant impact on a company’s financial health and growth prospects.

- Neglecting maintenance and upgrades: Failing to invest in regular maintenance and upgrades can lead to higher long-term costs and decreased efficiency. Ensure that Capex and Opex budgets include provisions for ongoing maintenance and upgrades.

- Ignoring tax implications: Capex and Opex have different tax implications, which can significantly impact a company’s financial performance. Ensure that your financial team is well-versed in the tax implications of Capex and Opex and factors these into decision-making processes.

By following best practices and avoiding common pitfalls, businesses can successfully navigate the complexities of Capex and Opex management, making informed decisions that support their financial health, growth prospects, and operational efficiency.